Are You IPO Ready ?

Every founder dreams of ringing the bell, seeing their company listed, and sharing that proud moment with their team.

But the truth is — the real IPO journey begins much earlier.

Step 1 is about IPO Readiness.

Before investors, regulators, and the public evaluate your company, you need to evaluate it first.

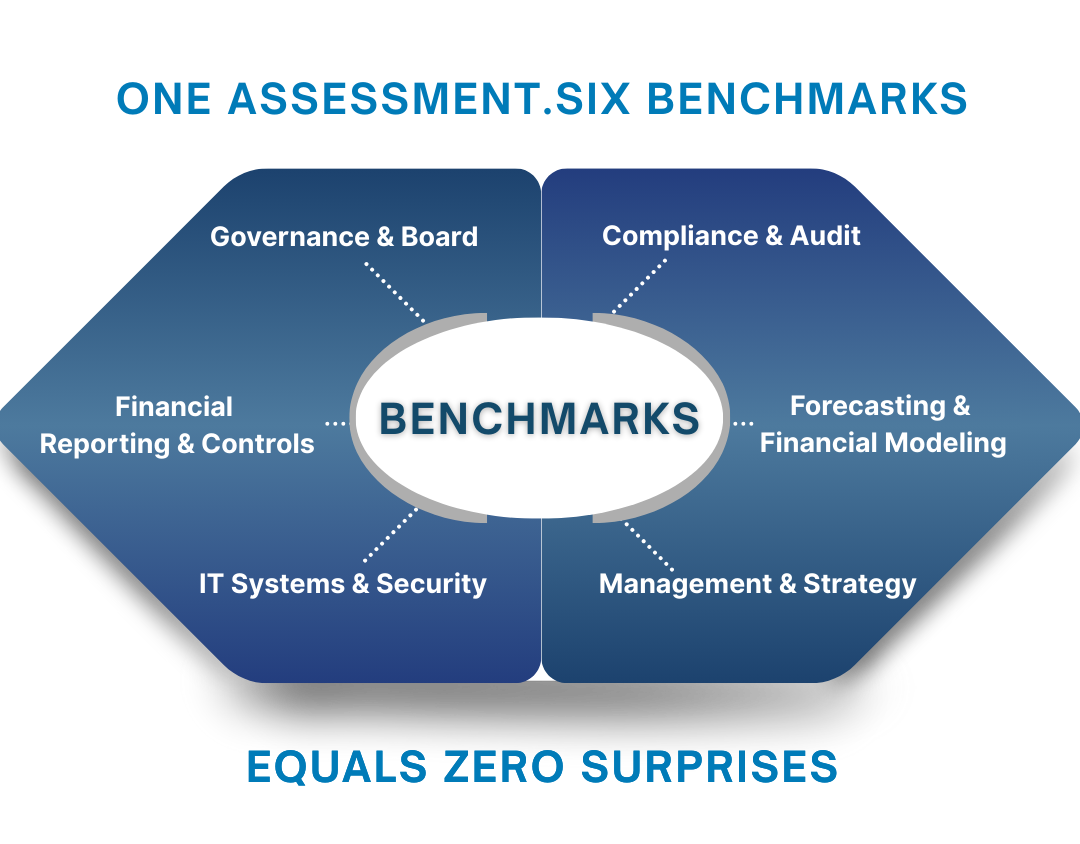

At Inscite Advisory, we conduct a comprehensive readiness assessment across six critical benchmarks.

This one assessment gives you a 360° view of your preparedness, highlighting strengths and uncovering blind spots — so when the spotlight is on, there are zero surprises.

With Inscite Advisory as your CFO partner, IPO preparation stops being overwhelming.It becomes structured, guided, and confidence-building.